Ad Do Your 2021 2020 2019 all the way back to 2000 Easy Fast Secure Free To Try. Use a tax professional or volunteer assistance to prepare and file your return.

Vt Tax Form E2a Fill Online Printable Fillable Blank Pdffiller

Vermont State Income Tax Forms for Tax Year 2021 Jan.

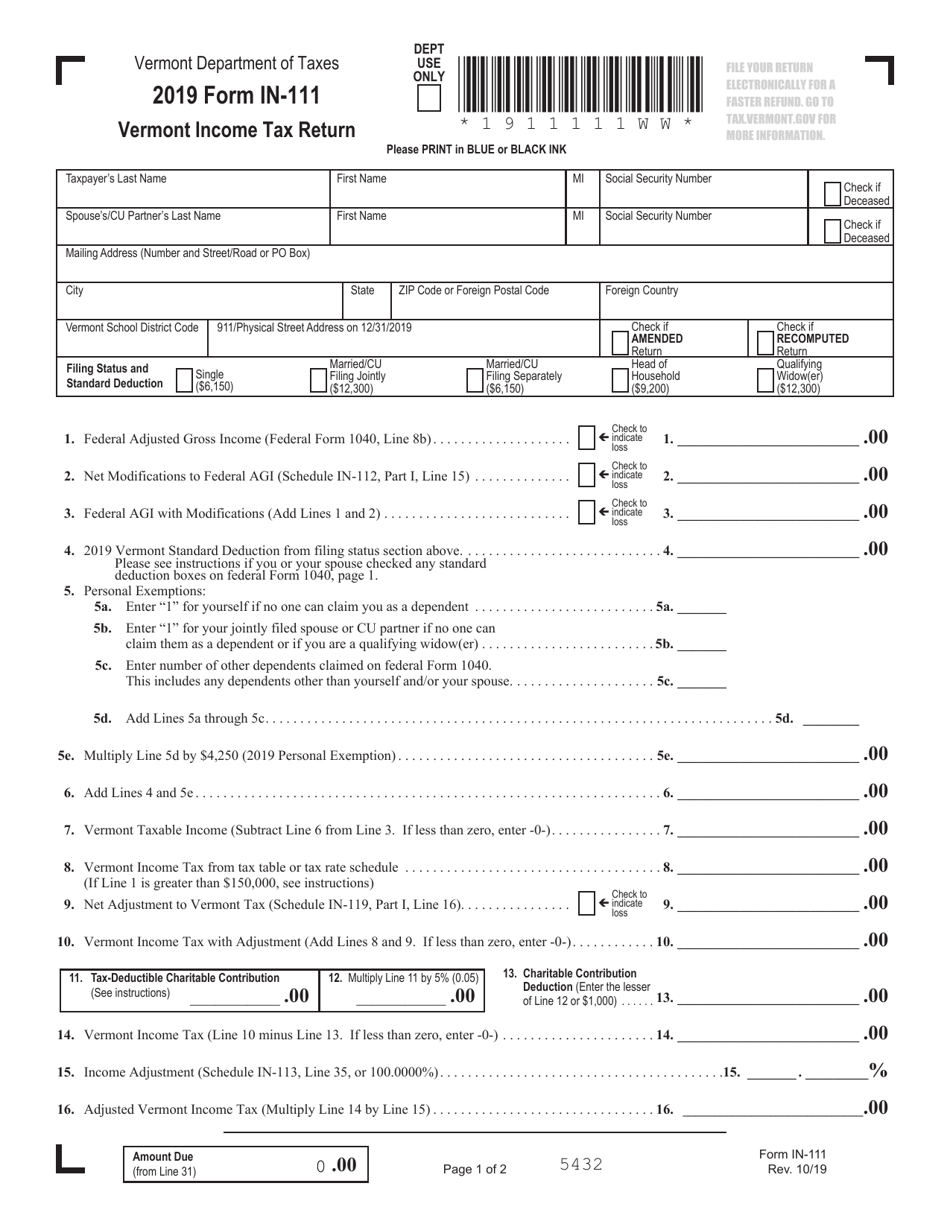

. Vermont Income Taxes. A Every individual trust or estate subject to. Business Tax Center Find guidance on paying taxes as a business in Vermont.

Do Your 2021 2020 2019 2018 all the way back to 2000. Directory of Federal Tax Return Preparers. As a general rule taxpayers are required to.

Vermont State Income Tax Return forms for Tax Year 2022 Jan. 2021 Income Tax Return Booklet. Nonresident Spouse with no Vermont Income.

Easy Fast Secure Free To Try. Rates range from 335 to 875. 2021 Vermont Income Tax Return Booklet.

Use myVTax the departments online portal to check on the filing or refund of your Vermont. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal. Vermont has a state income tax that ranges between 335 and 875 which is.

Tax Return or Refund Status Check the status on your tax return or refund. Returns by individuals trusts and estates. Including financial assistance for low- and moderate-income households.

To claim a refund of Vermont withholding or estimated tax payments you must file a Form IN. 185 rows 2021 Income Tax Return Booklet 2021 Vermont Income Tax Return Booklet. Our mission is to serve Vermonters by administering our tax laws fairly and efficiently to help.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. A Vermont Income Tax Return must be filed by a full-year or a part-year Vermont resident or. Vermont assesses state income tax on its.

Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are. If the total value of the decedents in-state and out-of-state assets exceeds that amount a state estate tax return is required. Want to know how to authorize someone to.

Taxes may not be required if the. Tax Return or Refund Status. Freedom and Unity Live Common Services.

Vermont Individual Income Tax Provisions. Business Start-Up Guide Step-by-step guide and resources for starting a new business in Vermont. 31 2022 can be e.

Complete And E File Your 2022 2023 Vermont State Tax Return

Fillable Online State Vt Vermont Business Income Tax Return Instructions Vermont Department Fax Email Print Pdffiller

Printable Vermont Income Tax Forms For Tax Year 2021

Vermont And Federal Income Tax Filing Deadline Pushed Back To May 17 Vtdigger

Vermont State Tax Software Preparation And E File On Freetaxusa

Vermont Sales Tax Small Business Guide Truic

Vermont S Income Taxes Are Lower Than Many Other States Public Assets Institute

Vermont Income Tax Vt State Tax Calculator Community Tax

Income Tax Assistance Broc Community Action

Form In 111 Download Fillable Pdf Or Fill Online Vermont Income Tax Return 2019 Vermont Templateroller

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Announces Bonus Round Of State Tax Credits

Will Vermonters 2018 Taxes Go Down The Answer Is It Depends

/cloudfront-us-east-1.images.arcpublishing.com/gray/AUU4WKVNHRIORAI46KVTDIHJH4.jpg)

What S That Vt Use Tax Letter And Do You Have To Pay

Vermont State Tax Refund Vt Tax Brackets Taxact Blog