Local sales and use tax increases to 2 bringing the combined rate to 75. Published by Scott Stewart on Sun 06142020 - 901pm.

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

This additional local sales tax in many cities places the average combined sales tax rate in Nebraska at around 7 percent although many cities are higher.

. Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate. The sales tax jurisdiction name is Sarpy which. The 775 sales tax rate in Omaha consists of 65 Arkansas state sales tax and 125 Boone County sales tax.

The Omaha sales tax has been changed within the last year. Groceries are exempt from the Nebraska sales tax Counties and cities can charge an. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

58 rows The state sales tax rate in Nebraska is 5500. Local sales taxes may result in a higher percentage. Table 5 Local Sales Tax Rates Ainsworth 04012008 15 0401199310 Albion 1001200615.

The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax. The minimum combined 2022 sales tax rate for Omaha Nebraska is 7. Several local sales and use tax rate changes will take effect in Nebraska on January 1 2019.

January 2019 sales tax. With local taxes the total sales tax. This is the total of state county and city sales tax rates.

For additional information on these. Free Unlimited Searches Try Now. The 55 sales tax rate in Offutt A F B consists of 55 Nebraska state sales tax.

You can print a 775 sales tax. Nebraskas sales tax rate is 55 percent. There is no applicable city tax or special tax.

Ad Get Nebraska Tax Rate By Zip. 05 lower than the maximum sales tax in NE. Omaha collects the maximum legal local sales tax The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax.

4 rows Rate. Ad Get Nebraska Tax Rate By Zip. Effective April 1 2022 the city of.

Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter. The Nebraska state sales and use tax rate is 55 055. 1 according to the Nebraska Department of.

Iowas is 6 percent. There are no changes to local sales and use tax rates that are effective July 1 2022. Free Unlimited Searches Try Now.

Updated March 3 2022 The following cities have adopted ordinances or made plat changes which have modified their city boundaries. As of January 1 2019 Nebraska requires certain out-of-state businesses to collect and remit. There is no applicable county tax city tax or special tax.

The Nebraska sales tax rate is currently 55. Gretna will see its sales tax rate increase from 15 to 2 effective Oct. The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68.

It was lowered 05 from 825 to 775 in March 2022 raised 05 from 775 to 825 in March 2022 and. There is no applicable county tax or special tax.

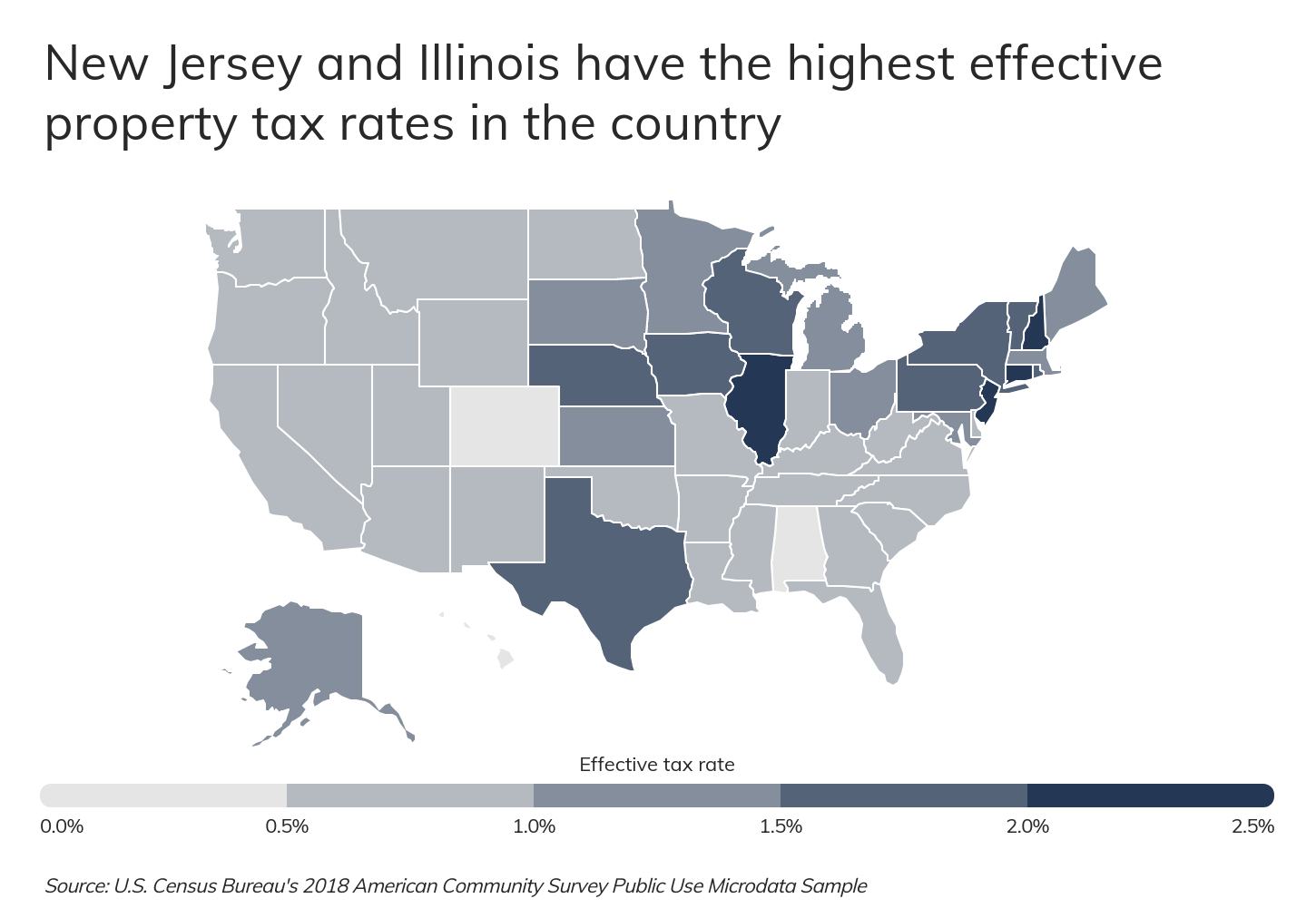

New Ag Census Shows Disparities In Property Taxes By State

States With Highest And Lowest Sales Tax Rates

Sales Taxes In The United States Wikiwand

States With Highest And Lowest Sales Tax Rates

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Tax Rates In Major Cities Tax Data Tax Foundation

The Cities With The Highest And Lowest Property Taxes Real Estate Buffalonews Com